Investment refers to the act of creating new financial resources or income streams by buying or selling assets. The ultimate aim in investing is to gain profits from the sale or purchase of an asset with the hope of gaining some benefit/profit in the future. Simply put, to invest simply means to acquire an asset or an entity with the intention of generating a specified profit from the investment or the accumulation of your investment that is, an increase in the monetary value of that asset over a defined period of time. In simpler terms, investment means to earn more money from your investment through the use of capital funds.

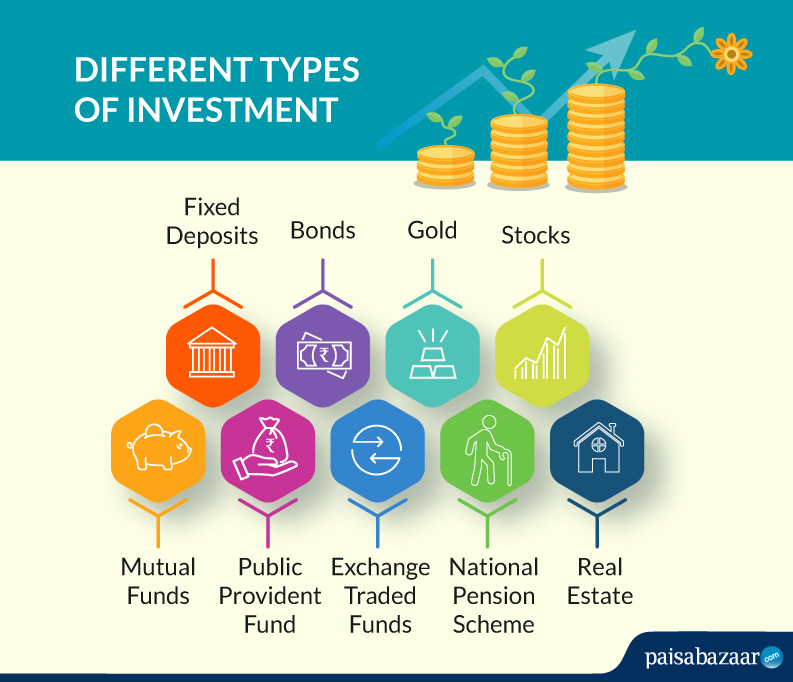

There are different ways in which you can make the most of your investment. These include saving and investment through stock market, bonds, mutual funds and savings account. A savings account is considered as an investment opportunity when one saves money each month for the purpose of making a lump sum investment in a particular asset. Usually, this type of savings account is secured against the equity of the home. On the other hand, stock market and bond investing refers to putting up your money in a corporation, institution, or a government agency so that you can earn dividends periodically.

Investing in stocks is an investment option for the general public. Basically, stock market refers to the buying and selling of shares on exchange traded markets, or exchanges, such as New York Stock Exchange and NASDAQ, with the objective of making a profit on the sale of your shares. Bond investing, on the other hand, refers to the purchasing of bonds, notes, and other securities with the purpose of increasing your savings account at regular intervals. Some people prefer bonds because they offer the highest interest rates.

Apart from stock market and bond investing, you can also opt for individual stocks, which are sold in the market in small amounts. Individual stocks have similar characteristics like those of shares; however, they are not purchased and sold in typical trading sessions. This form of investment is especially popular among individuals who are looking for steady returns. However, individual stocks do not provide the same high returns as those in other investment options. Individual stocks generally pay higher returns to people who buy and sell them regularly.

Another key takeaway is that, you need to be aware of how to manage your money and assets. For example, if you are planning to make an investment in bonds, it is essential that you take note of their interest rates and coupon payments. If you have a tendency to miss out on a coupon payment, your bond investments will suffer. This is why it is essential to understand your own financial documents thoroughly before deciding on what form of investment you will be taking. You should also take note of your personal spending habits before making investments, as certain investments may not work for you.

One of the best things about these types of investments is that, they are ideal for long term investors. An investor in stocks and bonds will not see substantial returns in the short term, but these investments are good for the long term because they offer a reliable income stream. Other important points to remember include: